Defense attorney James Filan has shared a revealing attachment on X, which discloses that the US Securities and Exchange Commission (SEC) has submitted its remedies, reply brief, and supporting documents. This latest development in the SEC vs Ripple Labs legal battle has sparked interest among investors, who eagerly await a conclusive outcome to inform their investment decisions. Filan’s disclosure indicates that the SEC’s publicly redacted versions of the documents will be filed on May 8, 2024. It is important to note that any supported exhibit not designated as confidential will be included in these versions.

In addition to this, both parties and third parties involved in the case are required to file an Omnibus letter motion in order to seal all materials related to the remedies-related briefing. As part of this process, the parties must also propose redactions to the material. Ripple, the SEC, and third parties have until May 20 to file opposition briefs to the omnibus letter motions to seal. Furthermore, all parties involved must file public, redacted versions of all documents within 14 days of the rulings on the sealing motions.

This recent development follows reports that Ripple and the SEC have been unable to reach an agreement regarding the testimony of Andrea Fox (Fox Declaration). Ripple argues that the testimony is an unsolicited expert opinion, while the SEC considers it to be “standard summary evidence in support of calculations for disgorgement.” The SEC claims that the Fox Declaration is based on information obtained from Ripple’s documents, including tax returns and financial statements that are crucial for determining the outcome of the case. However, Ripple maintains that the SEC has failed to show that the Fox Declaration is summary evidence rather than expert testimony.

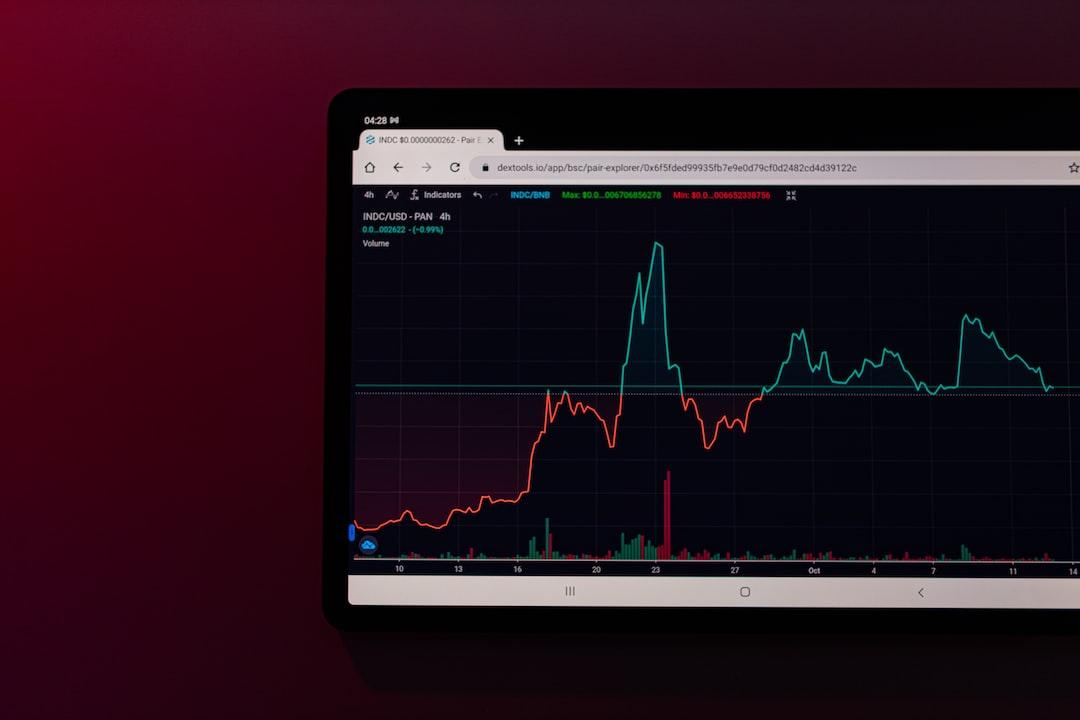

Prior to this, the SEC sought fines and penalties totaling $2 billion, while Ripple proposed a maximum penalty of $10 million. As for the XRP price analysis, the cryptocurrency has been struggling to break above the 50-day and 200-day EMAs, indicating a bearish signal. In the past 24 hours, it has experienced a 0.9% decline and is currently trading at $0.538. However, if it manages to break above the 50-day EMA, it could target the $0.5739 resistance level and potentially move towards $0.6. Analysts have noted that while XRP may have a bullish near-term outlook, it has a bearish longer-term signal based on its position above the 50-day EMA and below the 200-day EMA.

Overall, the legal battle between Ripple and the SEC continues to unfold, with significant developments and implications for both parties and the wider XRP community.