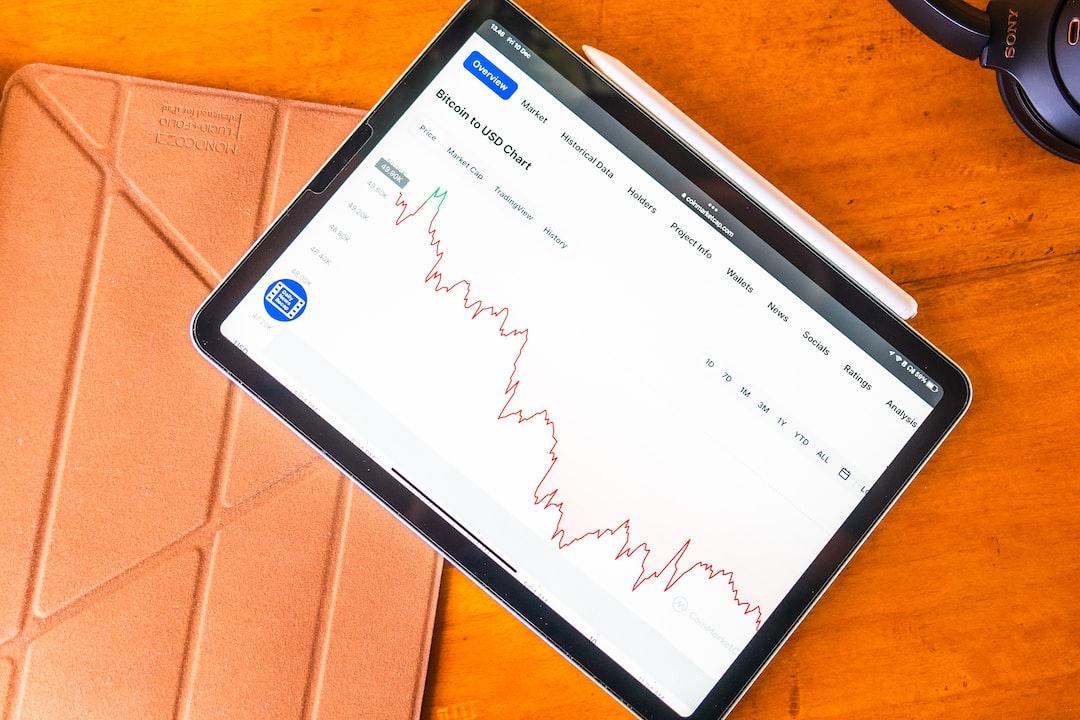

The cryptocurrency market is currently witnessing a significant downturn with Bitcoin retreating to the $50,000 range, sparking intense selling activity.

Bitcoin (BTC) has experienced a notable decline, dropping to $59,100 early Thursday morning. Investors are grappling with whether to seize the opportunity of this dip or await further potential drops to $50,000, or perhaps a surge to $70,000.

Bitcoin’s Decline and Market Challenges

Recent data from Santiment, an on-chain analytics platform, reveals that BTC has encountered several hurdles in the past two months. The cryptocurrency has now reached a two-month low, with many altcoins performing even worse. Traders who bought into the dip near the $60,000 mark have seen their long positions aggressively liquidated in the past few hours. Ethereum (ETH) and Solana (SOL) have also suffered similar setbacks.

Ethereum, for instance, plummeted to $3,200 despite expectations of a bullish trend following the upcoming launch of spot ETFs by mid-July. Santiment suggests that while many crypto enthusiasts view the current price drop as a buying opportunity, caution is advised. The firm recommends waiting out initial volatility before considering further investments, emphasizing that the optimal time to buy cryptocurrencies often coincides with periods of impatience and skepticism among traders.

Altcoins with notably low funding rates are highlighted as particularly attractive investments at present. Santiment identifies Balancer (BAL), Chromia (CHR), and Celer (CELR) as projects experiencing heavy shorting on Binance, positing that liquidations of short positions could drive price increases.

Bitcoin Whale’s Losses and ETF Trends

The recent market volatility has led to significant losses for a prominent Bitcoin whale, who reportedly lost approximately $20 million. According to on-chain data provider Lookonchain, the whale deposited a substantial amount of Bitcoin on Binance recently, accumulating over 5,281 BTC ($323 million) in the past week. Despite now holding 6,068 BTC ($358 million), the investor incurred losses in their latest trade.

Meanwhile, spot Bitcoin ETFs have continued to struggle, with daily net outflows reaching $20.5 million on July 3. Grayscale’s GBTC recorded significant outflows of $27 million, whereas Fidelity’s FBTC saw inflows of $6.5 million, standing out amidst a backdrop of zero inflows for other ETFs.

BTC’s Price Decline and Market Activity

Bitcoin’s price has further declined, currently trading at $57,702, marking a 5% drop over the past 24 hours. Trading volume surged by 58.5% to $36 billion, with the market cap holding steady at $1 trillion.

In conclusion, while the crypto market faces substantial volatility and challenges, it presents opportunities for strategic investment amidst fluctuating prices and evolving investor sentiment.